Starting a business is about passion. It’s about planting a flag in the ground and declaring to the world that right here, in this little spot, is where you’re going to start your empire. It’s about working 25 hours a day, and #hustling, and all that other stuff that sells on emotion.

But… there’s also a real, colder, harder, honest angle: You’ve got to make money. Maybe you need to make a lot. Maybe you just need to make a little. Or, maybe you don’t need to make any at all… but even then, you should be making sure you spend it wisely.

In the olden days

Here comes a shocker. For years, we tracked everything with an Excel file. It was a manual process, it was constantly messed up, and even though our accountant who did our taxes every year never told me so… he probably wasn’t a huge fan.

The process we used is “officially” called single-entry accounting. It wasn’t perfect, but it was free. It worked good enough because the business was small with relatively low volume of activity. It also made sense to me, because it was basically the same process for how we tracked our personal finances.

But if you’re expecting your business to grow, this method of bookkeeping has quite a few shortcomings. You can’t track an account for inventory. You have trouble tracking accounts payable and receivable, which becomes especially important as your customer base grows and you start selling volume to multiple accounts. Additionally, it’s mostly impossible to develop reports to see things like your balance sheet.

I knew that I needed (and wanted) to dive into the world of big-boy (or girl) accounting practices. But, boy howdy, was I ill-prepared for what a dramatic shift (and time investment!) it would end up being.

Who even competes with Quickbooks?

Nicole and I were recently having dinner with a friend and fantastic interior designer. She commented how much she appreciated Quickbooks since integrating it as her accounting software. You can guess what program we ended up using. It’s funny that even with the hyper-focused advertising tools available today, mouth-to-mouth promotion still resonates most.

Quickbooks has market recognition, they have a modern, cloud-based platform, and any research you do on small business accounting software will turn up Quickbooks near the top… along with several other companies you’ve probably never heard of.

The downside to of choosing a company you’ve heard of before is that you’re going to pay for it.

When the parent company has a stadium named after them and they run Super Bowl Ads for their product, that money’s gotta come from somewhere (Hint: your pockets).

Accounting software wasn’t something I wanted to split hairs over. It felt safe to pick the market leader, the price point seemed acceptable for us, and I was most interested on getting started quickly. Quickbooks made it the easy.

Then the headaches start

After making the flip to Quickbooks, I was ill-prepared for the dramatic investment of time and resources that would accompany the switch.

My exposure to “true” accounting was essentially nothing. Other than budgeting and expense tracking for my old job, I knew very little about actual double-entry bookkeeping.

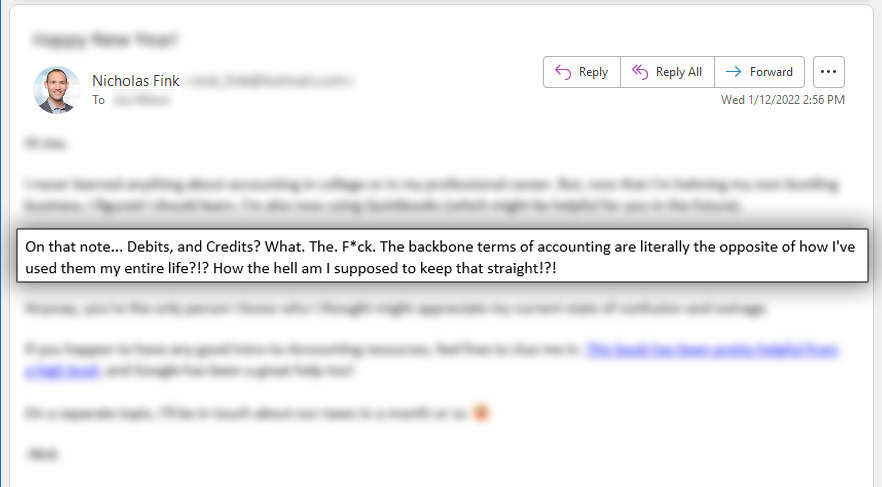

Just for starters… wrapping my head around the fact that a “debit” increases an account and a “credit” decreases it, was mind-blowing (related image below) and still something I struggle with.

The last couples months have included a significant investment of time and energy into educating myself about accounting fundamentals, Quickbooks Online, as well as the Amazon payments process. It’s been a lot, but our books have never been cleaner. I love being able to check my profit and loss, or balance sheet with a click, and have all my receipts in one place, directly attached to the expense.

Hopefully some of the challenges I’ve gone through might be helpful to you or someone else. So, without further ado, here’s a few handy resources that have helped me over the last couple months:

Accounting Made Simple

This is a great little reference book that’s been somewhat indispensable and I’ve referred back to several times. A real no-frills, nuts-and-bolts type of book for small businesses.

Financial Intelligence

Published by Harvard Business Review Press, this book takes a broader look at finance typically within larger organizations. I garnered a lot of insights here that would apply to my work as a manager in my previous role. I think there’s probably still some value for smaller businesses. I especially found interesting the parts discussing the “art” of finance, and how things aren’t always as cut-and-dry as it might seem at first glance.

LedgerGurus.com

LedgerGurus have carved out a niche serving smaller e-commerce businesses. They pump out really useful, free content on their blog on a regular basis. Definitely worth checking out.

A2X Accounting

This is a subscription service that I’ve added onto Quickbooks to simplify our Amazon deposits for bookkeeping. It does a fantastic job making sense out of the unbelievably complex statements from Amazon every two weeks.

https://www.a2xaccounting.com/

Successful Business Plan: Secrets & Strategies

Lastly, this book for startup businesses is just a great reference manual. I’ve also purchased their Business Plan Financials excel documents, which have been great for forecasting and projecting sales.

What burning accounting questions have I left unanswered? Let me know in the messages below.

Thank you for the shoutout!!! QuickBooks has been a game changer for my business in addition to my amazing bookkeeper. I love the ability to project and forecast numbers and wish I would have started with them sooner and had not waited a year.